This is always the most confusing part when I need to fill out so I'm sharing some tips to make it easier for you and future me. I have a Croatian based company that occasionally does business with US.

I think my tips apply to any EU-based company that needs to fill the tax info for US.

If you need to fill the tax info for the IRS and your company isn't in the US:

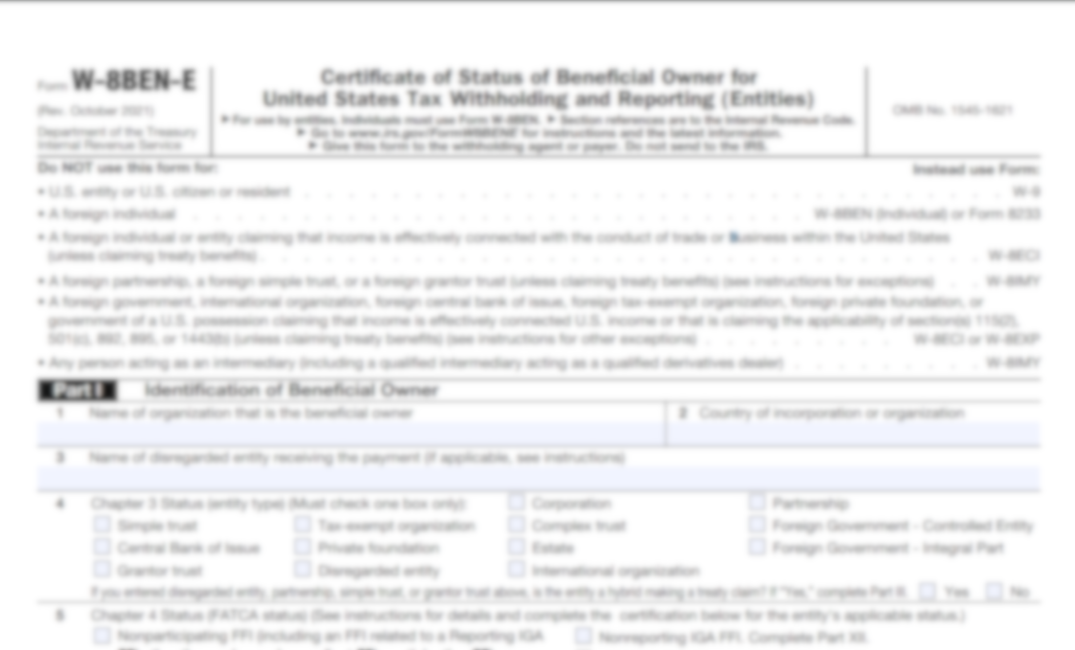

- Use a W-8BEN-E form - This is the form required for foreign entities. You can find an example form on IRS website.

- Enter Your Company Information: full name and address. When entering a name, web form might not allow dots or other special characters. In some forms (like google payments), tax form fields can only contain uppercase and lowercase letters (a-z, A-Z), numbers (0-9), spaces, hyphens (-), and ampersands (&). This is due to tax reporting requirements set by the IRS. Solution: put the name without the disallowed characters. For example Moja Firma d.o.o. is either Moja Firma doo or a Moja Firma društvo s ograničenom odgovornošću.

- Enter type of your company. It will likely be a Disregarded Entity or a Corporation: If company has a single owner, yes. Mine doesn't, then it's a corporation.

- Determine Your FATCA Status: FATCA stands for the Foreign Account Tax Compliance Act, and you must specify your status. If your company’s revenue comes mainly from commercial activities, like software programming services, you’re likely an “Active NFFE” (Non-Financial Foreign Entity).

- Provide Your FTIN (Foreign tax information number): it is not the same as VAT number. In Croatia it should be the same as OIB of the company, where the VAT is something like HR<company_oib>. Just fill the company OIB.

- Claiming tax treaty benefits - if from Croatia, skip it. Sorry, you can't claim it.

- Understanding FFI(Foreign Financial Institution): This applies to a bank, a fund or an investment company. In my case I don't need this.

- Authorized Signer: Ensure that the person signing the form has the legal authority to do so. If you’re a co-owner but not a director, you might not have the right to sign; the director should do this.

There will be a lot more fields to fill in the W-8BEN-E form, but they should be optional.

Conclusion

There will be a lot more fields to fill in the W-8BEN-E form, but they should be optional.

Disclaimer: I'm not an accountant. It's just something I went through too many times and bothered my own accountant to explain these terms to me.